It is VIX expiration today

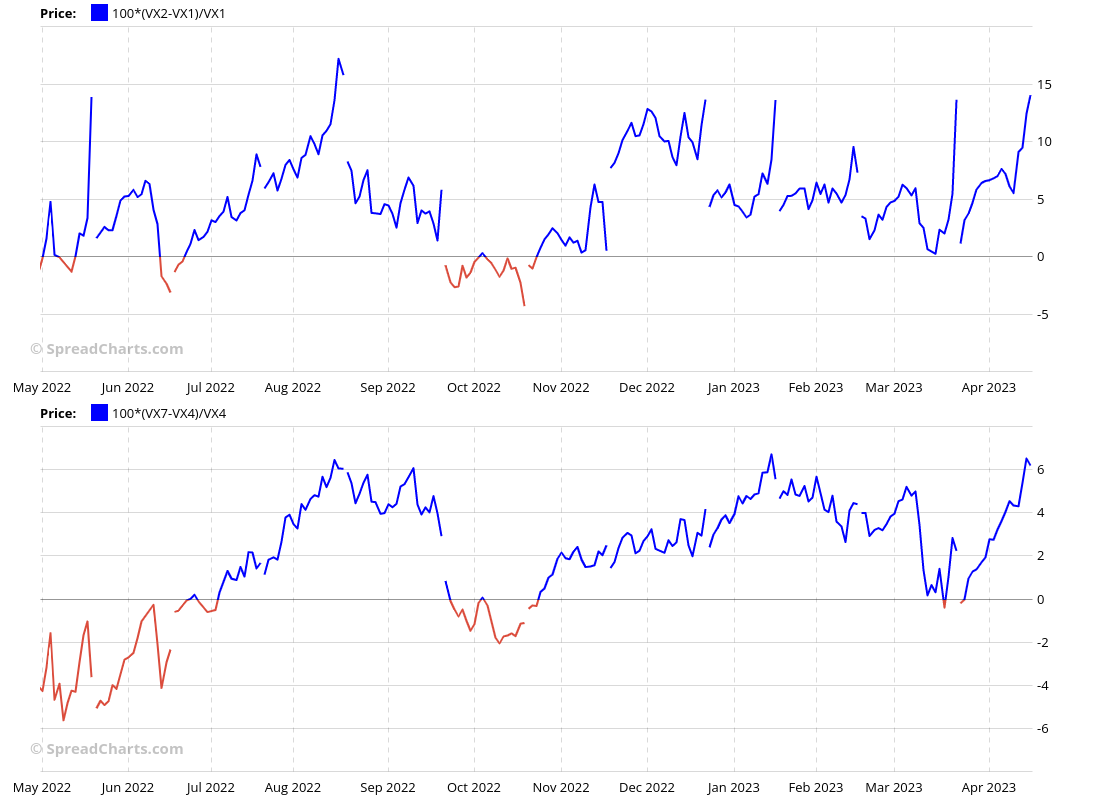

The April VIX futures contract expires today, and funny things can happen on such days. The contango at the front of the curve spiked to 14% yesterday, but the situation farther down the curve remains more calm.

This is caused by the front April contract being pulled to the spot, which is normal prior to VIX expiration.

This scenario is supported by the diverging VVIX, which acts as a benchmark of implied volatility for a basket of VIX options. VVIX is related to the VIX in the same way that VIX is related to SPX. When demand for VIX options increases, their implied volatility goes up, and this is reflected in the VVIX index going higher.

What does all of that mean? Well, if we take all of these effects into account, it implies a higher chance of a market turnaround after Wednesday. The VIX would rise, and stocks would fall in such a case.

Two caveats are appropriate here. First, it is a short-term effect only, and second, its reliability is not great. Think about it as a tendency of the market to behave in a certain way, not an iron rule.

If you enjoyed the article, please click the like button at the bottom. Thank you!

Disclaimer

All information in this post is for educational purposes only and is not intended to provide financial advice. If any financial instruments, strategies, securities, or derivatives are mentioned anywhere in this post, it is solely for educational purposes.

SpreadCharts s.r.o., its affiliates, and/or their respective officers, directors, and employees may from time to time acquire, hold, or sell securities mentioned here.

SpreadCharts s.r.o. and its representatives bear no responsibility for actions taken under the influence of information published anywhere in this post and linked resources. There is a risk of substantial loss in trading futures, options, stocks, ETFs, or other financial instruments.